Crypto Trading Bot: Architecture and Roadmap

Introduction

I decided to build a crypto trading bot, which will trade cryptocurrencies on some exchange, for example: Coinbase. Actually, the idea of building the trading bot has been in my mind since 2018. I tried to build it a couple of times, but continuously switched to something else. But this time my intention was serious, so I implemented the MVP for the crypto trading bot, and in this post, I will explain my vision of the crypto trading bot and the development roadmap for it.

Crypto Trading Bot Targets

Loading...

My targets of the crypto trading bot:

- To achieve a daily capital gain of 1%.

- To be able to trade different cryptocurrency pairs.

- To operate efficiently without high trading speed as this is not a high-frequency trading project.

- To be cost-effective in maintenance — I have limited time for my pet projects after work.

- To be cost-effective in hosting — pet projects shouldn’t consume too much money.

Crypto Trading Bot Architecture

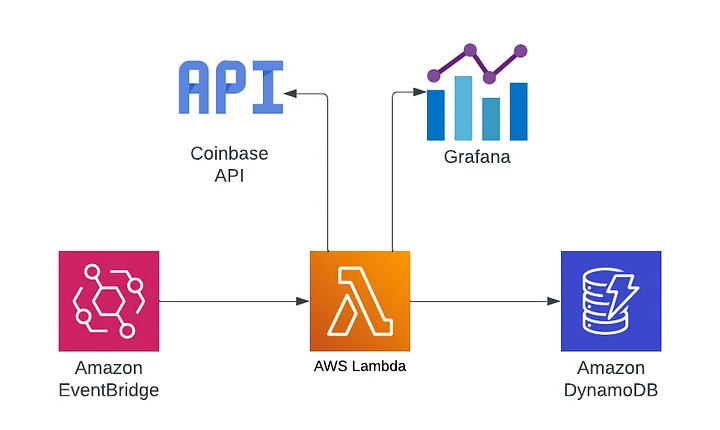

The core concept for the Crypto Trading Bot is shown in this high-level architecture diagram:

Loading...

- AWS Lambda was used to achieve low hosting costs for the bot because I have Free Tier compute minutes for AWS Lambda.

- Amazon EventBridge generates an event every minute, triggering a lambda.

- Coinbase API was chosen as the exchange API because I already had an account on this platform, and the documentation seemed good to me. I may add support for other exchanges in the future.

- Grafana was selected as the visualization tool for metrics and logs because its Free Tier provides 50 GB of storage and 7 days retention, which is sufficient for my project. Additionally, Grafana is a powerful tool for metrics, making it an obvious choice when I saw it offered for free.

- Amazon DynamoDB was chosen as the database due to its free tier in AWS and low costs for handling low data volumes.

Additionally, I developed the AWS Lambda functions in TypeScript because I decided to switch from Python to Node.js for quick prototyping, leveraging JavaScript’s capabilities as a language for both backend and frontend. TypeScript simplifies project maintenance with its type system, aligning with my goal of low-cost maintenance.

Crypto Trading Bot Algorithm

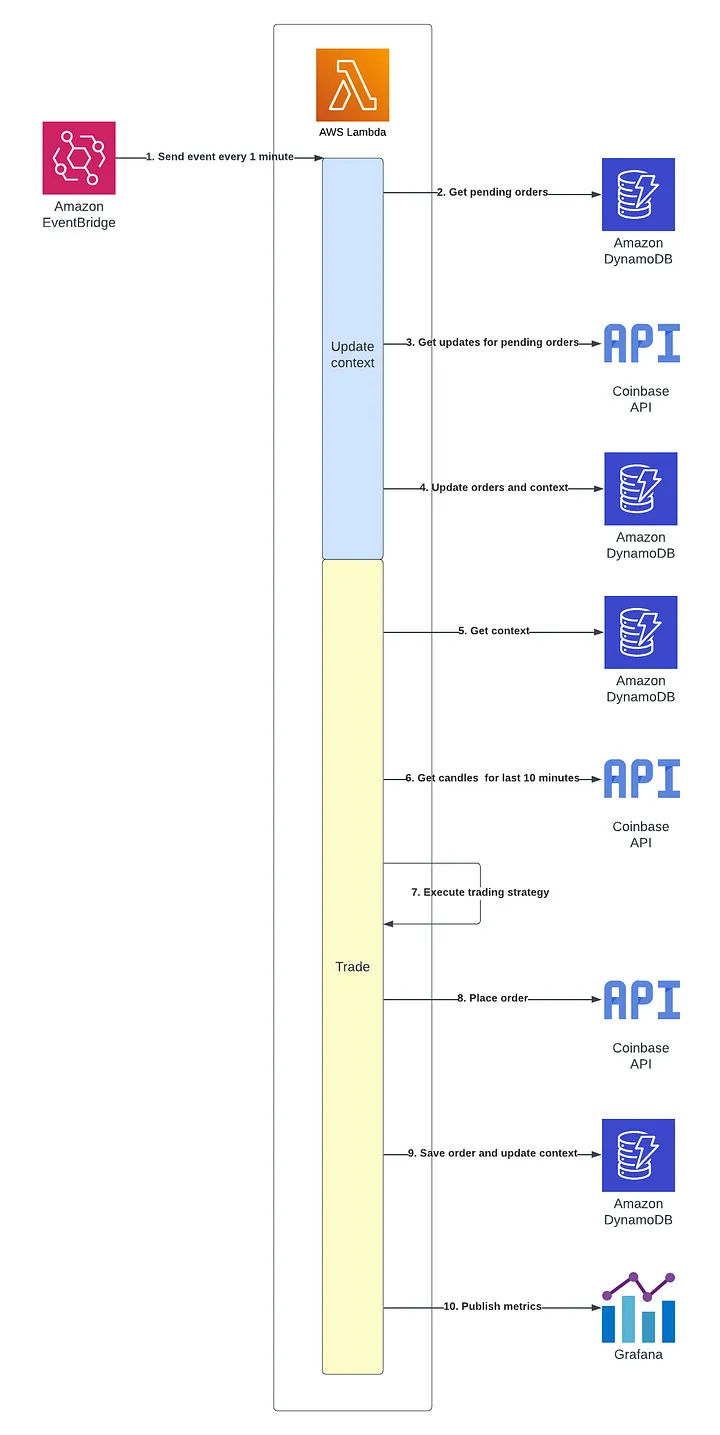

The algorithm for the bot contains two main stages:

update context— updating trading context based on the updates from Coinbase..trade— execute trading strategy on the market data and place orders.

The complete algorithm is shown in the diagram below:

Loading...

- Amazon EventBridge will send an event every minute to the AWS Lambda.

- AWS Lambda will retrieve all pending orders from DynamoDB to check if some of them are already filled, cancelled, etc.

- AWS Lambda will get updates for pending orders from the Coinbase API and compare them with pending orders received from the database.

- The lambda will save updated orders in the DynamoDB database and update the context by adding or removing money depending on the orders’ state.

- The lambda will retrieve the context from DynamoDB. Although the lambda already had context in the previous step, I decided to decouple the

update contextstage from thetradestage. Maybe in the future, there will be two separate lambdas or updating context will occur from the WebSocket event. - The lambda will retrieve candles for the cryptocurrency pair for the last 10 minutes. The time range of 10 minutes was chosen randomly; it may change in the future.

- Execute the trading strategy based on the trading context and historical candles received from Coinbase.

- If the decision is made to sell or buy, the order will be placed.

- The lambda will save the placed order and updated trading context to the DynamoDB database.

- The lambda will publish metrics to Grafana for visualization.

Crypto Trading Bot Roadmap

Loading...

Currently, I have implemented a locally running Crypto Trading Bot which has been running for 12 hours on the Coinbase sandbox from my laptop.

It started with 100 sandbox USD and traded with the BTC-USD pair. After working for 12 hours, it initially won 14 USD, but in the end, it lost approximately 48 USD, leaving the total amount of USD at 66 USD. So, the trading strategy currently is not working, but the MVP target was achieved — the bot is simply working. My next steps will be as follows:

- Deploy the bot to AWS Lambda while continuing to work on the Coinbase sandbox.

- Add Grafana support — I need to see the current trading strategy outputs because it wins something but loses everything. For better analysis, I need to have metrics from the bot.

- Create backtests for the trading strategy — download historical data for cryptocurrency pairs and execute my trading strategy on it.

- Improve the trading strategy with ChatGPT to have continuous capital gains in the backtesting — receive proofs that the trading strategy works.

- After receiving proof that the trading strategy works on the historical data, leave the bot for at least 7 days with a new strategy at the Coinbase sandbox environment for additional testing.

- If backtesting and testing during the 7 days at the Coinbase sandbox environment are successful — try to launch the bot on the main Coinbase environment with the real 10 USD; otherwise, continue improving the strategy until it becomes profitable.

The curious reader may ask me a question:

Why am I developing operational things, like monitoring, deployments, and so on, instead of focusing on the trading strategy?

The answer is this: I need to run a crypto trading bot in “production,” instead of developing a trading strategy that will never be used. One of the principles of software development is iterative development: delivering software continuously in small pieces. I decided to first implement the framework for a crypto trading bot that will simply work continuously and then focus on the unknown area for me, the “trading strategy.”

Conclusions

In this article, I described my new pet project — Crypto Trading Bot, its architecture, and roadmap. I didn’t delve into the details of implementation to keep the article concise; I may explain them in the next articles. Also, algorithmic trading is a completely new area for me, and it is very interesting, actually. So, my architecture explained in the article may change over time.

📧 Stay Updated

Get weekly insights on backend development, architecture patterns, and startup building directly in your inbox.

Free • No spam • Unsubscribe anytime

Share this article

Related articles

How I Built an AI-Powered YouTube Shorts Generator: From Long Videos to Viral Content

Complete technical guide to building an automated YouTube Shorts creator using Python, OpenAI Whisper, GPT-4, and ffmpeg. Includes full source code, architecture patterns, and performance optimizations for content creators and developers.

flow-run: LLM Orchestration, Prompt Testing & Cost Monitoring

Open-source runner for LLM workflows: orchestrate prompts and agents, run regression tests, control costs, and publish metrics for observability and CI/CD.